If you can answer these questions, then you have what it takes to become a Professional Trader…

What’s the most important thing to a professional trader, even more so than their trading capital?

Do you know who LOSES the most money in trading? (Hint: it’s not retail traders)

Do you know how much the best in the industry makes? No, it’s not turning $500 into $1m in a few short years.

Now:

If you’re stuck, don’t worry because the answers are contained in this article.

And you may not realize it yet, but in the next 10 minutes, you will know what it takes to become a professional trader — that most traders never find out.

Are you ready?

Let’s roll…

Just because you trade for a hedge fund doesn’t make you a professional trader. Here’s why…

Let me ask you:

When you hear the term Professional Trader, what comes to your mind?

You’ll probably think along hedge funds, bank traders, Institutions, right?

But here’s the thing…

Just because you trade for a hedge fund, a bank, or a huge institution doesn’t make you a professional trader.

Don’t believe me?

Then let me prove it to you…

The collapse of Barings, the oldest merchant bank in Britain

In 1995, Barings, the oldest merchant bank in Britain collapsed after incurring losses of $2.2 billion — by a rogue trader called Nick Leeson.

Nick was heavily long the Nikkei 225 and he kept averaging into his losses as the market went against him.

However, the Nikkei continue plunging after an earthquake hit Japan and his losses snowballed to $2.2 billion which led to the

collapse of Barings.

The bailout of Long Term Capital Management

Long Term Capital Management (LTCM) was founded by some of the most brilliant minds in finance including Nobel Prize winner, Myron Scholes and Robert Merton.

However in 1998,

LTCM nearly collapsed when it incurred staggering losses of $4.6 billion, and it required the Federal Reserve to rescue it.

This happened because LTCM was highly leveraged (holding about $30 for every $1 of capital) and betting the spreads on government bonds would converge.

Clearly, that didn’t happen when Russia default on its debt (in 1998) and the spread of the bonds diverged big time — which led to the $4.6 billion losses.

Bear Sterns collapse and bailout

In 2007,

Bear Sterns announced its first loss in 80 years. An $854 million and another $1.9 billion write-downs of its subprime mortgage holdings.

Then, Moody downgrade Bear Sterns to junk status which caused panic in the markets. And because of the junk status, no banks would lend it money.

Eventually, Bear Sterns was bought out by JP Morgan (with the help of the Federal Reserve).

Now let me ask you…

What did the failure of Barings, LTCM, and Bear Sterns have in common?

Attitude? Unlucky? Trading without an edge?

Nope.

It’s this…

Barings, LTCM, and Bear Sterns failed because they lack risk management.

You’re probably wondering:

What is risk management?

Well, it’s the way of managing your bet size (and portfolio risk) so you don’t lose all your trading capital — even if you have many losing trades.

And without risk management, you can’t exploit your edge in the markets… even if you have a profitable trading strategy.

Let me explain…

Let’s say you have a $1000 trading account:

- Your trading strategy has a winning rate of 50%

- It has an average of 1:2 risk reward ratio

Then, these are the outcome of your next 10 trades…

Lose Lose Lose Lose Lose Win Win Win Win Win

So, how much profit will you earn?

This depends on your risk per trade.

If risk 20% of your trading account…

You’ll lose your trading account (-20, -20, -20, -20, -20).

But what if is you risk 1% of your trading account?

You’ll earn a profit of 5% (-1, -1, -1, -1, -1, +2, +2, +2, +2, +2).

Now you might be wondering:

“But how do I calculate my risk on each trade?”

Don’t worry.

For now, let’s move on…

Professional traders don’t focus on their results. Here’s what they do instead…

Let me ask you…

Have you ever seen the lifestyle of a professional bodybuilder?

Then let me share with you (and it’s not what you think)…

5:00 AM – Wake up

5:30 AM – Breakfast

7:00 AM – Lift weights

9:00 AM – Post workout meal

12:00 PM – Lunch

1:00 PM – Pre-workout meal

2:00 PM – Reflect and work on weaker body parts

4:00 PM – Post workout meal

6:00 PM – Dinner

8:00 PM – Cardio and stretching

9:00 PM – Supper

10: 00 – Bedtime

Now you might be wondering:

“Why am I sharing this with you?”

Simple.

Professional bodybuilders focus on the PROCESS, not the results — and it’s the same for traders!

The result is a byproduct of the process you follow.

But don’t get me wrong.

The results matter.

BUT, you can’t improve what you’re doing by watching your results.

You only improve by tweaking and improving your existing process — and that’s how winning is done!

You’re wondering:

“So, what’s the process I should use?”

Don’t worry, I’ll talk about it later.

But for now, are you beginning to see how professional traders really work?

Next…

Professional traders know how much they can make, realistically

Here’s the thing:

Many new traders are lured into this industry with the promise of HUGE riches (with minimal time and effort).

Like taking a $1000 and magically transforming it into a seven-figure account within a few short years.

Well, I hate to burst your bubble but it’s not going to happen.

The best in the industry average about 20% a year — over the long run.

In the image below, you can see Warren Buffet’s average return is 14% more than the S&P 500 (over the last 55 years).

So, you’re probably wondering:

“If the best fund manager makes an average of 20%, then how much can a retail trader (like me) expect to make?”

It depends.

I know you dislike that answer but it’s the truth.

Because it depends on your risk management, timeframe, and strategy. There’s no one size fits all.

Now some of you might think…

“But day trading is different, you can make more than just 20% a year”

That’s true, but it’s not the complete picture.

Because here’s what you must know…

What trading gurus never tell you about day trading

- Day trading is not scalable

- Day trading has very high opportunity cost

- Day trading makes you a slave to the markets

Let me explain…

Day trading is not scalable

Okay, perhaps you’re a consistently profitable day trader.

But here’s the thing:

As your fund size increases, your % returns will decrease.

Why?

Because you’re trading larger and you start “moving” the markets. This means you can’t enter and exit your trades without suffering slippage.

For most markets, you can day trade with a 5, 6 or even 7-figure accounts.

But anything larger, you start becoming the market and your returns are greatly diminished.

Day trading has high opportunity cost

Imagine:

You’re earning $50,000 per year and you quit your job to become a day trader.

In your first year of trading, you earn $20,000.

That’s good news, right? WRONG.

Because that’s an opportunity cost of $30,000 had you stayed in the workforce.

And let’s be honest here.

Chances are, you won’t make money in your early years of trading so the opportunity is much higher than that.

Day trading makes you a slave to the markets

As a day trader, you can expect to work 12 – 16 hours a day.

Here’s the breakdown:

2 hours – Do your homework before the market opens

8 hours – Trade the session

2 hours – Trade review and journaling

Now, this is fine if you’re young in your 20s or 30s.

But what if you’re married? You have a family? Or you’re in your 60s?

Now…

If you still decide to pursue day trading, here are some tips to help you move:

- Set aside 24 months of living expenses that don’t involve your trading capital

- Trading is a business a business. And when you’re in business, don’t expect to make money in the early years

- Keep as much trading profits as you can because you don’t know when your next drawdown will come

- Know when to call it quits: If you’ve not met your expectations by a certain time, call it quits and move on (there’s no shame as you’ve given your best)

Moving on:

In the next section, you’ll discover the ONE thing professional traders protect at all cost – and it’s even more important than their trading capital…

The ONE thing that’s more important than your trading capital — and all professional traders have it

Here’s the deal:

When you blow up your trading account, it’s not the end because you can still top it up with “new” money (and start over again).

But…

When you lose your mental capital — it’s over.

You might be wondering:

“What is mental capital?”

Mental capital is the drive, the “fight”, and the determination you have to undertake your trading endeavor.

For example:

When you’re in a drawdown, it’s your mental capital that helps you stick to your trading rules so you can play out your edge in the long run.

When your

trading strategy doesn’t have an edge, it’s your mental capital that drives you to seek more knowledge.

When you have a bad trading day, it’s your mental capital that tells you everything is alright and you’ll come back stronger the next day.

Now you might be thinking:

“If mental capital is so important, then why do traders lose it?”

That’s a good question.

From what I’ve seen, most traders lose their mental capital in 1 of 2 ways:

- You have the fear of losing and you are afraid to put on the next trade

- You have zero confidence in your trading strategy and yourself

Let me explain…

You have the fear of losing and it makes you afraid to put on another trade

Now, why does this happen?

Because you risk too much on one trade. And when it went against you, you lost a huge chunk of capital — or even your entire trading account.

This makes you afraid to put on the next trade as you fear it might happen again.

But here’s the good news.

It’s easy to fix this problem.

You have zero confidence in your trading strategy and yourself

This issue affects traders who have been trading for a few years (or even a long time).

You try out the different trading strategies and systems, but you’re still losing consistently or breakeven at best.

That’s because you don’t have a process to follow and you’re hopping like a bunny for the latest trading systems.

So, what’s the solution?

You need a

proven trading method that guides your trading so you can constantly improve your trading and become a consistently profitable trader.

Do you want to learn more?

Then read on…

How to become a professional trader using the “IDERR” method

You’re wondering:

“What is IDERR?”

I’ll explain…

I – Identify your trading methodology

There are so many types of trading strategies out there. Which will you choose?

Position trading?

Swing trading?

Day trading?

Scalping?

So here’s what I suggest…

You’ll be exposed to different trading styles by successful traders, and learn the essentials of what it takes to be a

consistently profitable trader.

Once you find a trading style that resonates with you, go all out and learn everything you can about it. (Let’s assume you want to be a successful swing trader).

Here’s how…

Books – Go to Amazon, and read books on “Swing trading”. I would suggest sticking to trading books with 4 stars or higher

YouTube – Watch videos on swing trading and look for those with high rating

Google – You can always find hidden gems here. Search for topics on “swing trading” and you’ll be amazed at the wealth of information available

As you acquire trading knowledge, I would encourage you to write it down, or save it in a word document.

This is to track what you’ve learned and to find out “the stuff” that makes sense to you.

D – Develop your trading plan

So, you’ve done your research and have attained a wealth of knowledge.

Next, you want to use your new found knowledge and develop it into a trading plan (a set of rules that details how you’ll trade the markets).

And here are 7 questions your trading plan must answer…

1. What is your time frame?

You must define the

time frames you’re trading. If you’re a swing trader, then you’ll probably be trading the 4 hour or daily time frames.

2. What markets are you trading?

You must state which markets you’ll be trading. It could be equities, forex, futures etc.

3. How much are you risking on each trade?

This boils down to risk management. You must know how much you’re prepared to lose on a single trade.

For starters, I would suggest no more than 1%. This means if you have a $10,000 account, you cannot lose more than $100 on each trade.

4. What are the conditions of your trading setup?

You must know the requirements of your trading setup. Whether you’ll

trade with the trend, within a range, or both (For starters I would suggest trading with the trend).

5. How will you enter your trade?

Will it be a limit, stop or market order?

6. Where is your stop loss?

No professional trader would enter a trade without a stop loss. The first thing you must ask yourself is, “where will I get out if I’m wrong?”

7. How will you exit your winners?

And if the price moves in your favor, you must know where to take your profits.

Disclaimer: Below is a sample trading plan I came up with randomly, please do your own due diligence.

Sample trading plan

I’ll be using the IF-THEN syntax in my trading plan.

Example:

If I’m a boy, then I’ll wear pants.

If I’m a girl, then I’ll wear a skirt.

If I’m not a boy or a girl, then I’ll be naked.

You get my point.

Let’s begin…

If I am trading, then I will only trade EURUSD and AUDUSD. (The markets you are trading)

If I’m trading currencies, then I’ll focus on the daily charts (Timeframe traded)

If I place a trade, then I will not lose more than 1% of my account. (Your risk management)

If the price is above 200 EMA on daily, then the trend is bullish. (Conditions before entering a trade and time frame you are trading)

If the trend is bullish, then identify an area of support where price could retrace to. (Conditions before entering a trade)

If price retrace to your area of support, then wait for a higher close. (Conditions before entering a trade)

If price closes higher, then enter long at next candle open. (Entry)

If you’re long, then place your stop loss below the low of the candle, and take profit at swing high. (Exit when you’re wrong, and when you’re right)

Next…

E – Execute your trades consistently

Once you’ve completed your trading plan, it’s time to take it to the markets.

I would suggest starting really small on a live account because you’re going to suck really bad (for a start at least).

And if that’s the case, why not pay lesser in “tuition fees”, to Mr. Market?

Now…

When you execute your trades, 1 of 5 things can happen.

- Break even

- A small win

- A big win

- A small loss

- A big loss

If you eliminate #5, you are much closer to being a profitable trader.

Now…

You must execute your trades consistently according to your trading plan.

Because if you’re entering trades based on how you feel instead of following your plan, then it would be impossible to tell whether your strategy has an “edge” in the markets.

Second…

You cannot change your trading plan after a few losing trades. Even though I know you’re tempted to do so.

Why?

Because in the short run, your trading results are random. And eventually, it’ll be closer towards its expected value.

This means you should have at least 100 trades before coming up with a conclusion whether your trading plan works, or not.

R – Record trades

Simply executing your trades isn’t enough.

Because the only metric you get is your P&L. This doesn’t help improve your trading, except knowing whether you’re making money, or not.

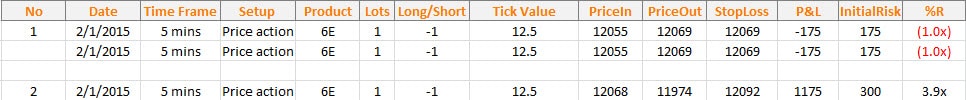

Here are the metrics you should record:

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that triggers your entry

Market – Markets you’re trading

Lot size – Size of your position

Long/Short – Direction of your trade

Tick value – Value per tick

Price in – Price you entered

Price out – Price you exited

Stop loss – Price where you’ll exit when you’re wrong

Profit & Loss in $ – Profit or loss from this trade

Initial risk in $ – Nominal amount you’re risking

R – Your initial risk on the trade, in terms of R. If you made two times your risk, you made 2R.

An example below:

R – Review your trades

Once you’ve executed 100 trades consistently, you can review whether your trading strategy has an edge in the markets.

To do so, you need to use the expectancy formula below:

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + Slippage)

If you have a positive expectancy, congratulations! It is likely that your trading strategy has an “edge” in the markets.

But what if it’s a negative expectancy?

Trade with the trend

By trading with the trend, you’ll trade along the path of least resistance which will improve your performance.

Set a proper stop loss

You want to

set your stop loss based on the structure of the markets and not the dollar amount you’re willing to risk.

Remove large losses

You can do this by risking no more than 1% on each trade. If you’re not sure how to do it, go read this post on risk management and position sizing.

Identify patterns

You want to

identify patterns that lead to your winners and focus on these profitable setups.

Likewise, identify patterns that lead to your losers and avoid trading these setups.

Conclusion

I know I’ve shared a lot about how you can become a professional trader.

So, take your time to digest the materials and review them again.

And here’s a recap of what you’ve learned:

- You don’t have to work for a bank, hedge fund, or institution to become a professional trader.

- Professional trading is a mindset, not a title

- A professional trader focus on the PROCESS, not the results

- A professional trader knows how much he can make realistically without blowing his account up

- A professional trader protect his mental capital at all cost

- The IDERR method that helps you become professional trader